hankyoreh

Links to other country sites 다른 나라 사이트 링크

Would a second wave of COVID-19 benefit the stock market?

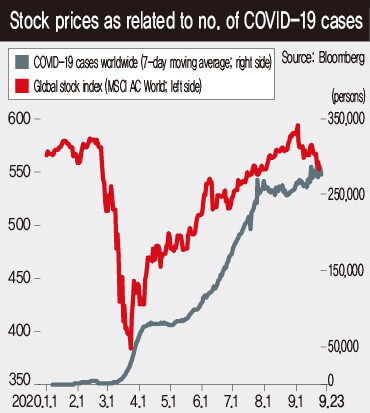

The global stock market has been registering major gains since last April, when COVID-19 was spreading throughout Europe and the US. The initial fear in the market was that the economy and stock prices might collapse in tandem due to the virus. There was of course a rapid chill in the business climate and a precipitous drop in stock prices early on in the contagion, but it only lasted for a short time. Ever since the US Federal Reserve announced the unlimited quantitative easing on Mar. 23, global stock prices have continued to rise even as the virus has continued to rapidly spread.

Strictly speaking, the virus hasn’t been bad for the market. The virus has enabled zero interest rates and large-scale fiscal policies, and the global “dream stocks” that are riding high at the moment have also been the biggest beneficiaries of the low interest rates and “untact” (non-face-to-face) environment. But will the virus continue to present itself as a stock market ally? It’s a question that hinges on the rate of the disease’s spread. If the daily global caseload continues at its current level of just over 300,000, it’s difficult to predict that the different economies will tank even harder and stock values will plummet. A certain level of virus activity can serve to boost the prices of technology stocks and current untact-related stocks.

But the story changes if the virus begins spreading anew. People may have learned by now that a second pandemic offers a good opportunity to purchase stocks cheaply, but things are not that simple. The following are some of the risk factors associated with a second pandemic.

The first is the deterioration of business conditions and company profits. The timeline for the global economy’s recovery to pre-virus levels is predicted to be after the second half of 2022 -- much later than initial predictions -- and economic forecasts will inevitably err on the conservative side. In the case of the European economy, the growth rate for the second quarter was -11.8%, and we may see a similar level of negative growth for the fourth quarter.

Second, a rough second virus wave will detract from countries’ ability to respond in policy terms. The world has already played the policy card a good deal. In effect, most countries have nowhere to go any lower with their interest rates, nor do they have a lot of fiscal resources to supply.

Third, the fact that stock prices have risen considerably since a few quarters back poses a potential burden. Many global stock markets have already exceeded pre-virus levels; US technology stocks have risen by over 20% from the beginning of the year. Whether you look at it in terms of total stock market weight (market capitalization) or relative strength of leading stock prices relative to the market as a whole, current prices are overheated enough to call to mind the dot com bubble from 20 years ago.

Neither a prolonged pandemic nor a swift eradication would benefit marketsIf the coronavirus renews its assault on the global village, we can’t simply expect that things will play out more or less the same way they did during the first half of the year, with a short-term decline followed by a rapid recovery. Some of the stocks that have become too expensive relative to their value may start “acting up,” and the limits of policy will become more and more apparent as economic lockdowns drag out. To be sure, the schedule for vaccine distribution will become more concrete while this is going on, and we’ll have an answer as to when this nasty bug will finally start backing off. But even if we see a swift dawn to the virus’s eradication, that is not necessarily good news for stock prices. Interest rates will start to turn, and the liquidity environment that everyone’s been enjoying will change.

From an investor’s perspective, both a serious spreading situation with the virus and a too-swift end to it are potential sources of problems. The conditions that allow stock prices to rise have recently become more and more difficult to meet. To avoid becoming victims of the virus in a financial sense, this is a moment that calls for the wisdom to take a broad view of the periphery and distinguish the actual good news from the bad, rather than approaching the market with too much haste.

By Kim Han-jin, senior economist at KTB Investment & Securities

Please direct comments or questions to [english@hani.co.kr]

Editorial・opinion

![[Column] The state is back — but is it in business? [Column] The state is back — but is it in business?](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0506/8217149564092725.jpg) [Column] The state is back — but is it in business?

[Column] The state is back — but is it in business?![[Column] Life on our Trisolaris [Column] Life on our Trisolaris](https://flexible.img.hani.co.kr/flexible/normal/500/300/imgdb/original/2024/0505/4817148682278544.jpg) [Column] Life on our Trisolaris

[Column] Life on our Trisolaris- [Editorial] Penalties for airing allegations against Korea’s first lady endanger free press

- [Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- [Guest essay] Maybe Korea’s rapid population decline is an opportunity, not a crisis

- [Column] Can Yoon steer diplomacy with Russia, China back on track?

- [Column] Season 2 of special prosecutor probe may be coming to Korea soon

- [Column] Park Geun-hye déjà vu in Yoon Suk-yeol

- [Editorial] New weight of N. Korea’s nuclear threats makes dialogue all the more urgent

- [Guest essay] The real reason Korea’s new right wants to dub Rhee a founding father

Most viewed articles

- 1[Column] Why Korea’s hard right is fated to lose

- 2Amid US-China clash, Korea must remember its failures in the 19th century, advises scholar

- 3[Column] The state is back — but is it in business?

- 4[Column] Life on our Trisolaris

- 560% of young Koreans see no need to have kids after marriage

- 6AI is catching up with humans at a ‘shocking’ rate

- 7[Editorial] Yoon must halt procurement of SM-3 interceptor missiles

- 8Hybe-Ador dispute shines light on pervasive issues behind K-pop’s tidy facade

- 9[Editorial] Stagnant youth employment poses serious issues for Korea’s future

- 10[Column] Can Yoon steer diplomacy with Russia, China back on track?